FAQs about invoice book legal requirements — what business owners need to know

FAQs about invoice book legal requirements — what business owners need to know

Blog Article

Leading Tips for Efficiently Managing Finances With an Invoice Book in Your Business

Reliable economic management is essential for any kind of business, and an invoice publication plays a significant function in this procedure. It acts as an essential tool for monitoring earnings and expenditures while ensuring timely repayments. Picking the appropriate billing book and arranging invoices successfully are fundamental actions. There are added strategies to enhance general effectiveness. Comprehending these approaches can significantly affect a service's monetary security and development possibility. What are one of the most effective practices to contemplate?

Understanding the Importance of an Invoice Book

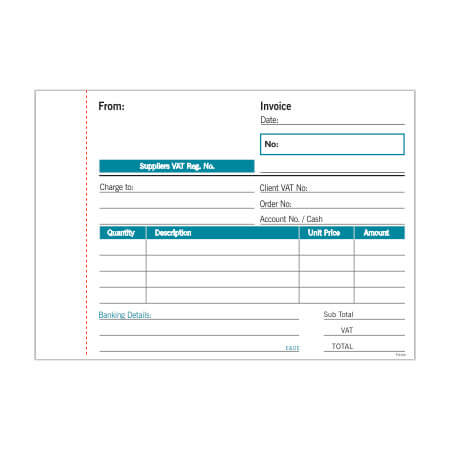

An invoice book works as an essential tool for companies seeking to maintain organized financial documents. It enables companies to document deals methodically, ensuring that all sales and services provided are accurately tape-recorded. This methodical paperwork is essential for tracking revenue, keeping track of capital, and managing expenses.Moreover, an invoice publication help in preserving professionalism in organization ventures. Supplying clients with comprehensive billings improves integrity and count on, cultivating stronger customer relationships. Furthermore, it streamlines the process of declaring taxes, as all essential financial details is readily available and arranged.

Choosing the Right invoice book for Your Service

Picking the ideal billing publication is necessary for businesses seeking to enhance their financial administration. The selection often rests on a number of crucial variables, consisting of the nature of business, the quantity of transactions, and particular invoicing demands. Little organizations with fewer deals could benefit from a simple, pre-printed invoice book, while bigger business might call for customized alternatives that allow for detailed inventory and branding.Additionally, businesses need to consider whether they like a physical or electronic layout. Digital invoice books can provide enhanced functions like automatic computations and simple information storage space, while physical books provide a concrete record. It is also important to review the publication's design for clearness and simplicity of use. Eventually, the right billing book will certainly not just promote reliable invoicing but likewise add to far better capital monitoring and enhanced client connections.

Organizing Your Invoice for Easy Accessibility

Organizing billings effectively is necessary for any company, as it ensures quick accessibility to important economic papers when required. A methodical method can improve performance and lower anxiety throughout audits or financial analyses. It is suggested to categorize invoices by kind, customer, or day, enabling simple retrieval. Using color-coded folders or labeled areas within a billing book can facilitate this procedure, making sure that files are conveniently identifiable at a glance.Moreover, maintaining a digital backup of physical billings can give an added layer of security and accessibility. Routinely reviewing and removing outdated billings will assist keep the system workable, avoiding mess. Developing a routine for arranging and keeping invoices, whether everyday or weekly, can substantially simplify financial operations. By focusing on organization, businesses can save time, decrease errors, and sustain much better financial decision-making, eventually bring about enhanced general administration of finances.

Keeping An Eye On Payments and Due Dates

Keeping an eye on payments and due days is necessary for keeping monetary stability. Organizing repayment timetables can help individuals handle their cash circulation successfully while minimizing late charges. Additionally, establishing reminder alerts assurances that no repayment due dates are ignored.

Organize Settlement Routines

Establishing a clear repayment schedule is crucial for maintaining financial security and guaranteeing timely money circulation. Businesses can gain from arranging repayment schedules by classifying billings according to their due days. This approach enables very easy recognition of upcoming repayments, enabling positive monitoring of cash resources. By segmenting invoices into weekly or month-to-month timelines, companies can concentrate on critical settlements while additionally evaluating patterns in money inflow. Furthermore, an organized routine aids in projecting future financial requirements, which is significant for budgeting functions. Constantly examining and updating settlement timetables guarantees that no due dates are missed out on, promoting strong partnerships with customers and vendors. Eventually, a reliable repayment routine improves total financial monitoring and supports an organization's development objectives.

Establish Tip Signals

How can businesses guarantee they never miss a payment due date? One efficient approach involves establishing tip signals. By applying automated suggestions, businesses can ensure timely alerts for upcoming settlements and due days. invoice book. This can be achieved through numerous techniques, such as schedule applications, invoicing software program, or dedicated pointer apps.These notifies can be set up to inform individuals days or even weeks beforehand, allowing adequate time for preparation. Furthermore, organizations ought to think about categorizing suggestions based upon priority, assuring that important repayments receive special interest. By consistently making use of reminder informs, organizations can improve their capital administration and maintain positive partnerships with customers and providers. Eventually, this proactive approach decreases the danger of late charges and fosters economic stability

Carrying Out Consistent Billing Practices

Although numerous businesses identify the importance of prompt settlements, executing regular billing methods usually proves tough. Developing a standardized invoicing procedure can significantly enhance cash circulation monitoring. This consists of setup details intervals for providing billings, whether regular, bi-weekly, or monthly, depending upon the nature of the company and customer relationships.Furthermore, companies should ensure that invoices are clear and detailed, describing services provided, settlement terms, and due days. Using a systematic strategy to act on exceptional billings is just as essential; tips can be click here automated to preserve professionalism and trust and consistency.Additionally, educating staff on the billing process can promote liability and precision, decreasing mistakes that may postpone settlements. On a regular basis assessing and changing invoicing methods can aid companies remain lined up with industry standards and client assumptions, inevitably advertising a much healthier monetary environment. Uniformity in these methods not only boosts performance however additionally constructs trust with customers.

Utilizing Invoice Templates for Effectiveness

Making use of billing templates can considerably improve the efficiency of the invoice creation procedure. By improving this job, services can save time and minimize mistakes, permitting quicker payment cycles. In addition, personalizing layouts for branding purposes guarantees that invoices mirror the firm's identification, strengthening professionalism and reliability in customer communications.

Improving Invoice Production Refine

Simplifying the invoice creation procedure can significantly improve an organization's efficiency and accuracy. invoice book. By using pre-designed invoice templates, services can reduce time invested in drafting billings from the ground up. These design templates typically consist of important areas, such as client details, itemized solutions, and settlement terms, making sure that all essential information are caught consistently.Furthermore, using invoice software application can automate calculations and reduce the chance of human mistake. This not just quickens the process yet additionally enhances record-keeping by keeping an electronic archive of all invoices provided. Additionally, standard design templates can facilitate quicker testimonials and approvals within the organization, enabling prompt billing and enhancing capital. In general, a reliable invoice production process is important for keeping financial wellness in a competitive market

Customizing Design Templates for Branding

Tailoring billing themes for branding can considerably enhance a business's expert photo while guaranteeing effectiveness in the invoicing procedure. By incorporating business logos, color pattern, and typography that show the brand name identification, organizations create a cohesive appearance that promotes count on and acknowledgment amongst customers. Customized themes can additionally streamline data entry by integrating pre-filled fields for client info and solutions supplied, reducing errors and conserving time. In addition, consisting of customized messages or terms of solution can enhance client partnerships. Organizations should consistently review and update their billing makes to line up with any type of branding modifications, making certain that their payment procedure remains an extension of their brand. This strategic strategy not just boosts performance however likewise strengthens the brand's presence in the marketplace.

Routinely Reviewing Your Financial Health

Frequently Asked Concerns

Exactly how Typically Should I Update My invoice book?

The frequency of updating an invoice book varies by business requirements. Normally, it is suggested to upgrade it regularly, preferably after each purchase, to preserve precise records and facilitate reliable economic monitoring.

Can I Utilize Digital Invoices As Opposed To a Physical Publication?

The concern of utilizing digital invoices instead of a physical book indicates a change towards modern economic monitoring - invoice book. Digital invoices offer convenience and accessibility, permitting services to improve processes, lower paper waste, and improve record-keeping efficiency

What Should I Do if a Billing Is Lost?

If an invoice is shed, the individual ought to immediately alert the client, reissue a replicate invoice, and document the circumstance for record-keeping. Maintaining a clear interaction route can stop prospective misconceptions or conflicts.

Just how Do I Deal With Late Settlements Successfully?

Handling late repayments properly involves sending out polite pointers, developing clear settlement terms in advance, and keeping open interaction with customers. Applying an organized follow-up process can substantially reduce delays and enhance capital for the company.

Is It Needed to Maintain Duplicates of Expired Invoices?

The need of maintaining copies of expired invoices varies by industry and legal requirements. Some companies maintain them for referral, audits, or tax obligation objectives, while others might discard them, depending on their operational needs and policies.

Report this page